Post the financial crisis of 2008, financial firms that trade directly with other firms (as opposed to a listed exchange/marketplace) are subject to an ever-increasing number of regulatory requirements. Think Dodd-Frank, EMIR, REMIT, MiFID II, and their analogues in each regional jurisdiction around the globe. While some of these regulations are broad in scope, at the heart lies the responsibility of record-keeping and disclosure by trading firms. By shining a light on otherwise dark over-the-counter markets, regulators hope to provide systemic stability.

Let’s leave aside any concerns about whether or not regulators can even accomplish this herculean task (more on that to come). What I want to highlight is the impact of all this on today’s trading compliance officers.

Compliance officers tend to be from a legal background as the function requires quite literally, ensuring firms comply with the law. But what happens to that legal oriented mind when it has to design a process that take trade and order data from multiple systems (from inside and outside the firm), filter for a subset of activity, transform, enrich, and send it to regulators anywhere from every 15 minutes to every day.

Let’s also note that they must choose an approved market solution provider to which to report trades, once trades have been sent they must ensure all validations are passed, and they may have to reconcile all activity with counterparties. This is just a glimpse into the variables which of course vary by region. You get the picture…mental overload.

Inevitably, compliance officers have teams in IT handling all this and making it easy, but here’s where we see a major split.

Compliance professionals who can manage to stand up a Compliance view of trades, regulatory database if you will, covering all corners of the institution (yes even those exotic trades in a spreadsheet) will comfortably fold into the new world and use it to their advantage. Those who don’t will of course benefit from increased budgets towards compliance but for how long? The mantra remains…justify the spend by delivering insights for the business.

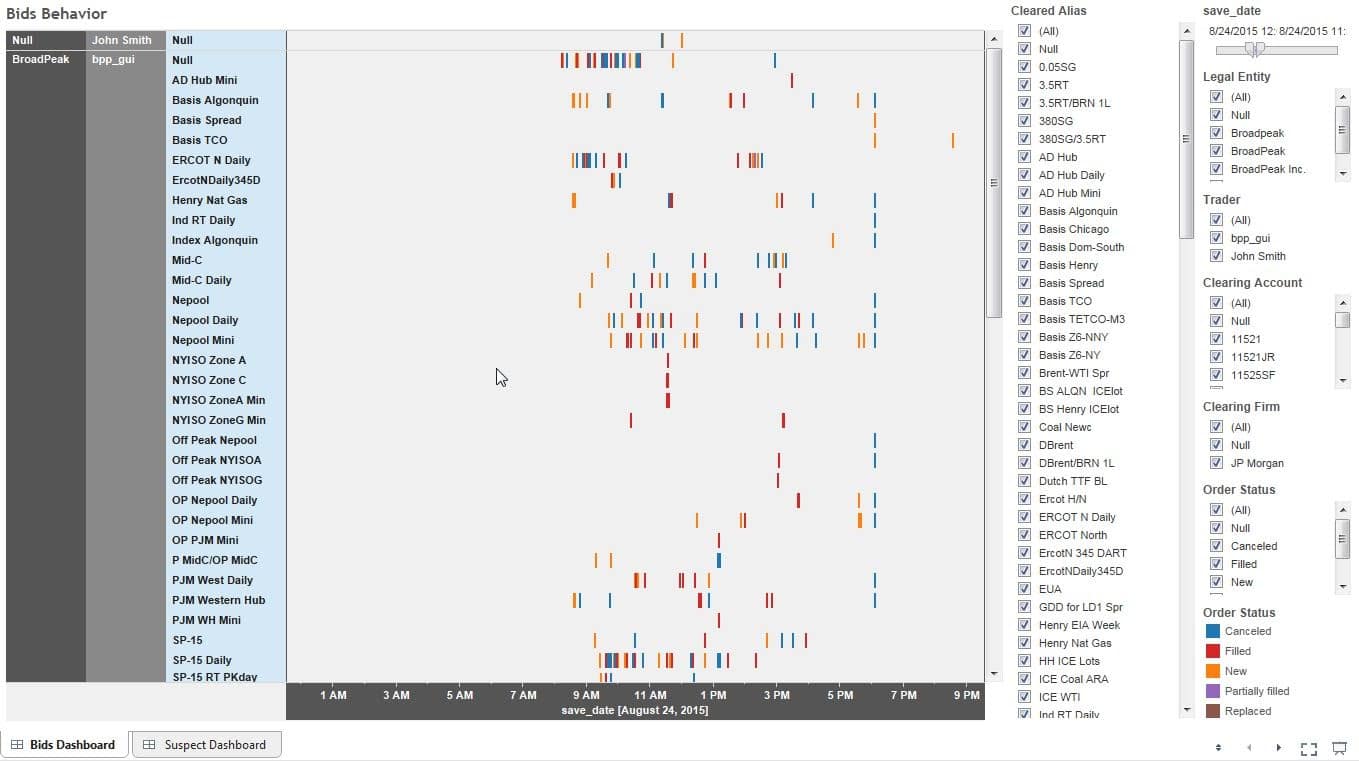

Because much of this data has remained siloed, understanding where it comes from, how it is sent/received, and how each source represents activity allows the new age officer to turn an otherwise costly project into meaningful insights. For example, bringing in order data into a single can produce reports that convey market behaviour in ways that a spreadsheet cannot.

All this change has opened the door for smart financial tech professionals to focus more heavily on compliance data and help firms develop increased capabilities. But resist the temptation to fully offload these complexities onto such professionals without an innate understanding yourself. The new world inextricably unites data and the law and compliance officers who can make the jump will deliver much more with their budgets than those who do not.