K3 for Trading

Trade Surveillance

Elevate Your Oversight with BroadPeak Trade Surveillance

BroadPeak is the sole provider offering a robust surveillance system that monitors both physical and financial trading activities. Our solution provides seamless connectivity for accessing orders and trades from most of the largest global exchanges, such as ICE, CME and Nodal, along with compatibility with a broad range of execution platforms for other venues.

We streamline data into a uniform format, making it easily accessible for alerting and investigation. This standardization supports compliance with both internal policies and external market surveillance regulations, allowing you to keep a vigilant eye on trading activity.

Internal Data Sources:

Our integration with your C/ETRMs systems guarantees that physical trade data is not left unchecked, ensuring cross-market surveillance that enables visibility into all the firm’s exposures.

Orders Data:

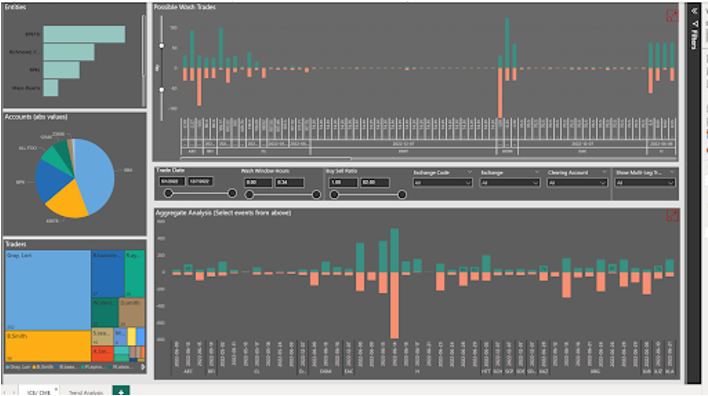

With K3, you're equipped to capture every bid, cancel, amend, and quote acknowledgement, protecting you against potentially manipulative practices like spoofing, layering and wash trades.

BroadPeak’s Trade Surveillance Covers You:

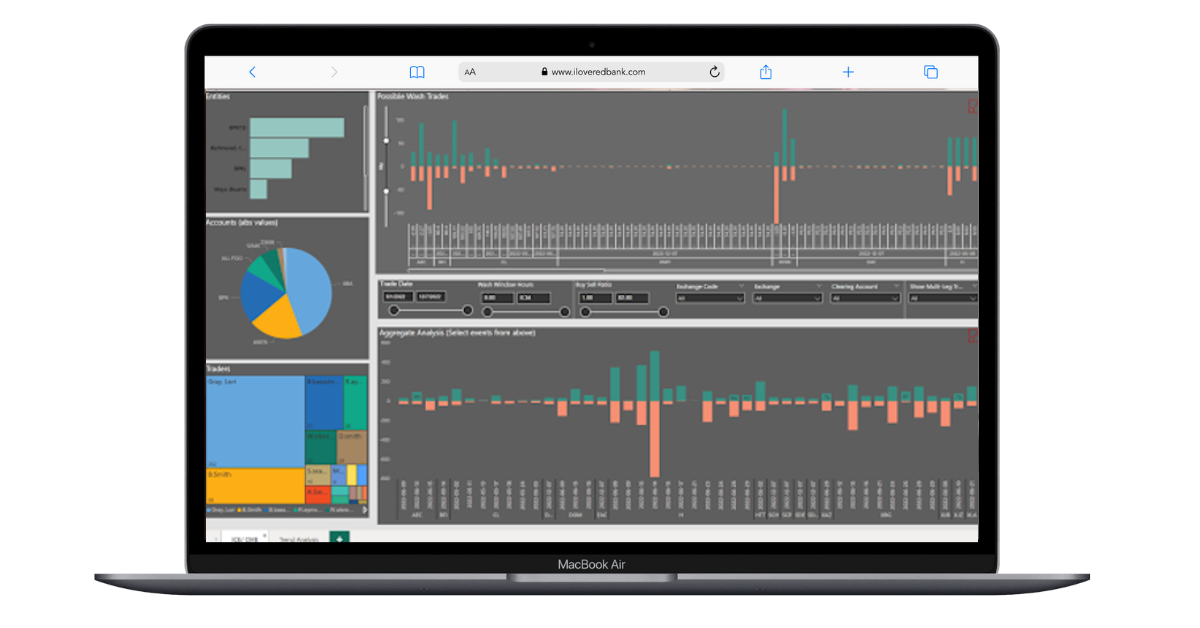

Wash Trading

Slamming the Market

Slamming the market is the deliberate execution of large orders near the beginning or end of market sessions to effectuate the price of a financial instrument.

By analyzing trade volumes, price movements and order patterns, BroadPeak Surveillance enables organizations to identify suspicious activity around market opening and closing periods.

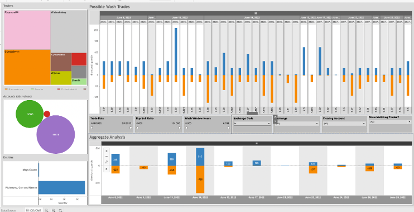

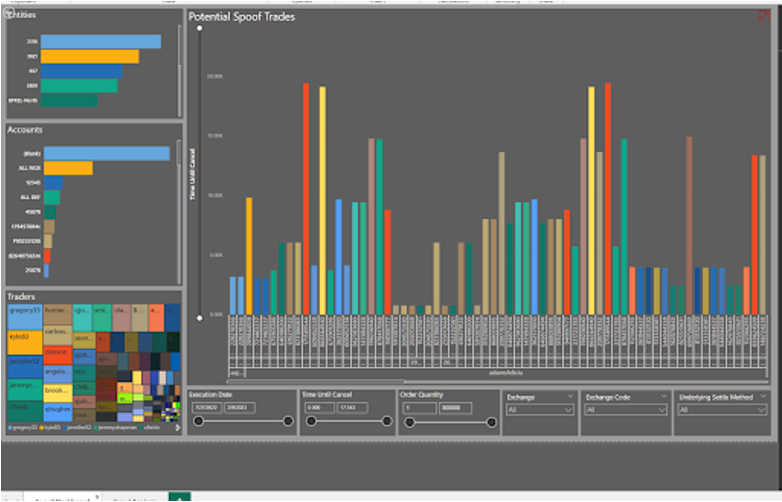

Spoofing

Placing orders to buy or sell a commodity with no intent of execution by cancelling the orders in quick succession. Misleading other market participants about market interest, liquidity, demand or price direction.

BroadPeak surveillance pinpoints suspicious activity such as rapid order cancellations or large, manipulative bids and offers enabling organizations to proactively address market manipulation and uphold market integrity while ensuring compliance to rules and regulations.

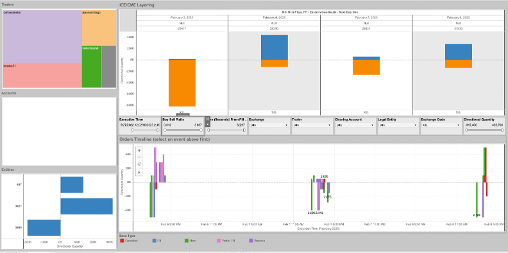

Layering

Designed to identify when a trader is active on both sides of the market. Similar to spoofing, disingenuous orders are placed on one side to influence price movement in a desired direction. As the market reacts, and prices shift accordingly, genuine trades are executed on the opposite side to capitalize on the movement. The undesired orders are then cancelled before they can be filled.

BroadPeak Surveillance detects layering by analyzing order activity and identifying patterns where multiple orders are strategically placed at different price levels to manipulate market perception. The system flags suspicious layering activity, empowering firms to closely examine trader behavior and uncover potential instances of manipulation.

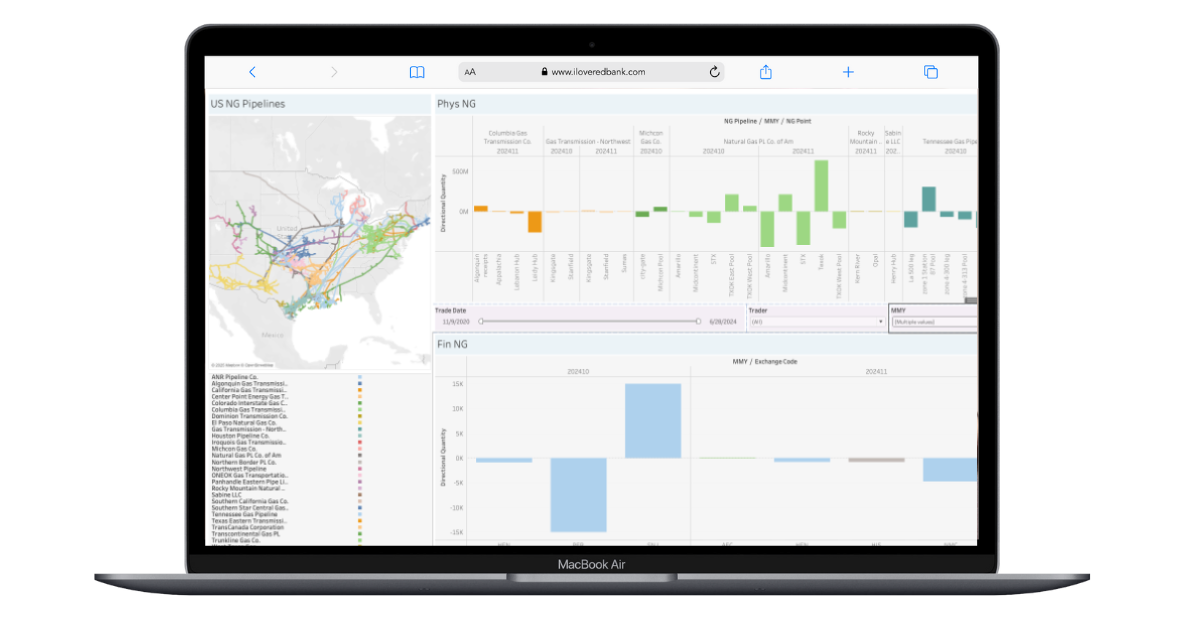

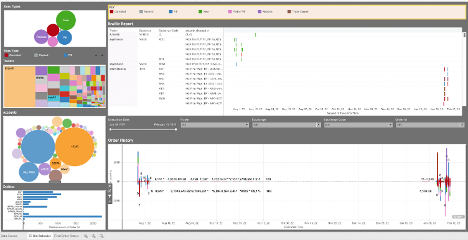

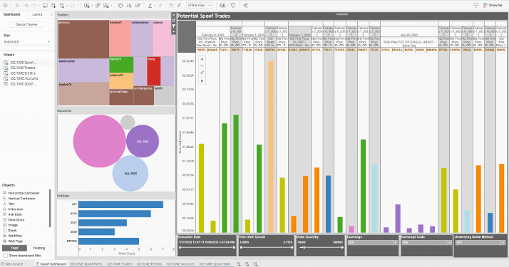

Physical vs. Financial Manipulation

BroadPeak Surveillance is the only solution on the market that seamlessly integrates an organization’s physical portfolios into its surveillance module. This capability provides organizations with comprehensive visibility into their current physical positions and financial hedging activities categorized by asset class and location.

Compliance officers have newfound visibility into where traders may be using physical positions to influence the settlement of derivatives.

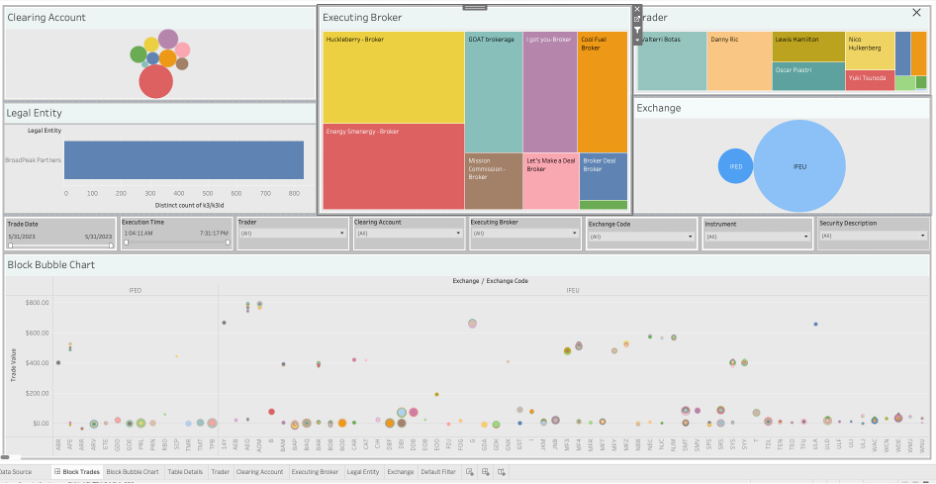

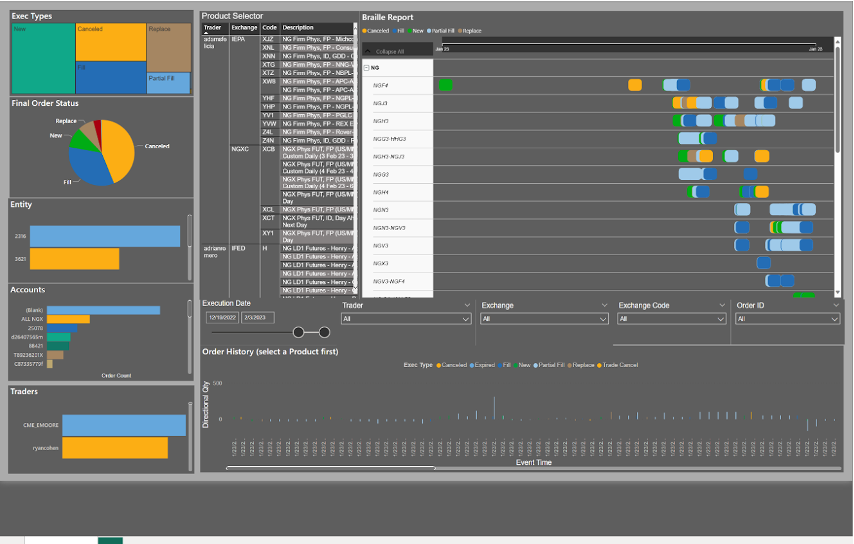

Block Trades

Privately negotiated transactions involving large quantities executed outside the public order book are still subjected to specific rules, reporting requirements and minimum size thresholds set by exchanges.

BroadPeak Surveillance enables users to monitor and analyze block trades with unparalleled clarity; enabling firms to identify unusual trading patterns, ensure compliance with regulatory and exchange requirements and maintain market integrity when managing large transactions.