FAQs about ICE Releases new Wash Trades

This month the Intercontinental Exchange (aka ICE) released a revised Wash Trade FAQ document. This isn’t simply arbitrary guidance. It comes after considerable review with the CFTC, who list it along with the previous edition on their site. The last version was issued a little over 6 years ago and the new edition addresses washing in context of the take-over of electronic trading. The old version referred to the “trading floor”, language entirely absent from the new version. Lastly, it moves away from the more securities oriented term “wash sale” and fully adopts the term “wash trade”.

So what is a wash trade? From the FAQ: “A wash trade is a transaction or a series of transactions executed in the same Commodity Contract and delivery month or Option series at the same, or a similar, price or premium for accounts of the same Principal.” “A wash trade occurs when there is an act of entering into, or purporting to enter into, transactions with no intent to obtain a bona fide market position…”

In simple terms, if you make offsetting trades in a given product/contract month, you are giving the false appearance of activity in the market. But this isn’t for a single trader…the “you” in this case is the corporate parent. Say you have two traders across the pond from each other and trading under different entities. One buys 100 lots of WTI at the market open and the other sells 100 lots at the market open. The parent entity will have no net position and this could be considered a wash trade. Two things stick out…

- This speaks nothing of intent of the two traders. What it comes down to is that any open /close at the same price is automatically suspect. It’s the compliance officer’s job to establish whether there was proper intent to obtain a bona fide market position.

- The updated guidance refers to trades done at a “similar” price. This is much broader than the previous version which defined washing as trades at the “same” price. It makes sense in context of electronic markets which move fast, but does broaden the scope of what could be a wash. Compliance officers’ job just got harder. Now we have to track everything within a penny? Two?

What does this mean for me or my firm?

It means you should have basic capability to monitor every suspect wash trade. I would go further by saying this requires a substantive command of the data and the analytics to support it. When the exchange or regulators inquire about possible suspicious trades, quickly producing data to substantiate activity along with a narrative around intent is your best foot forward.

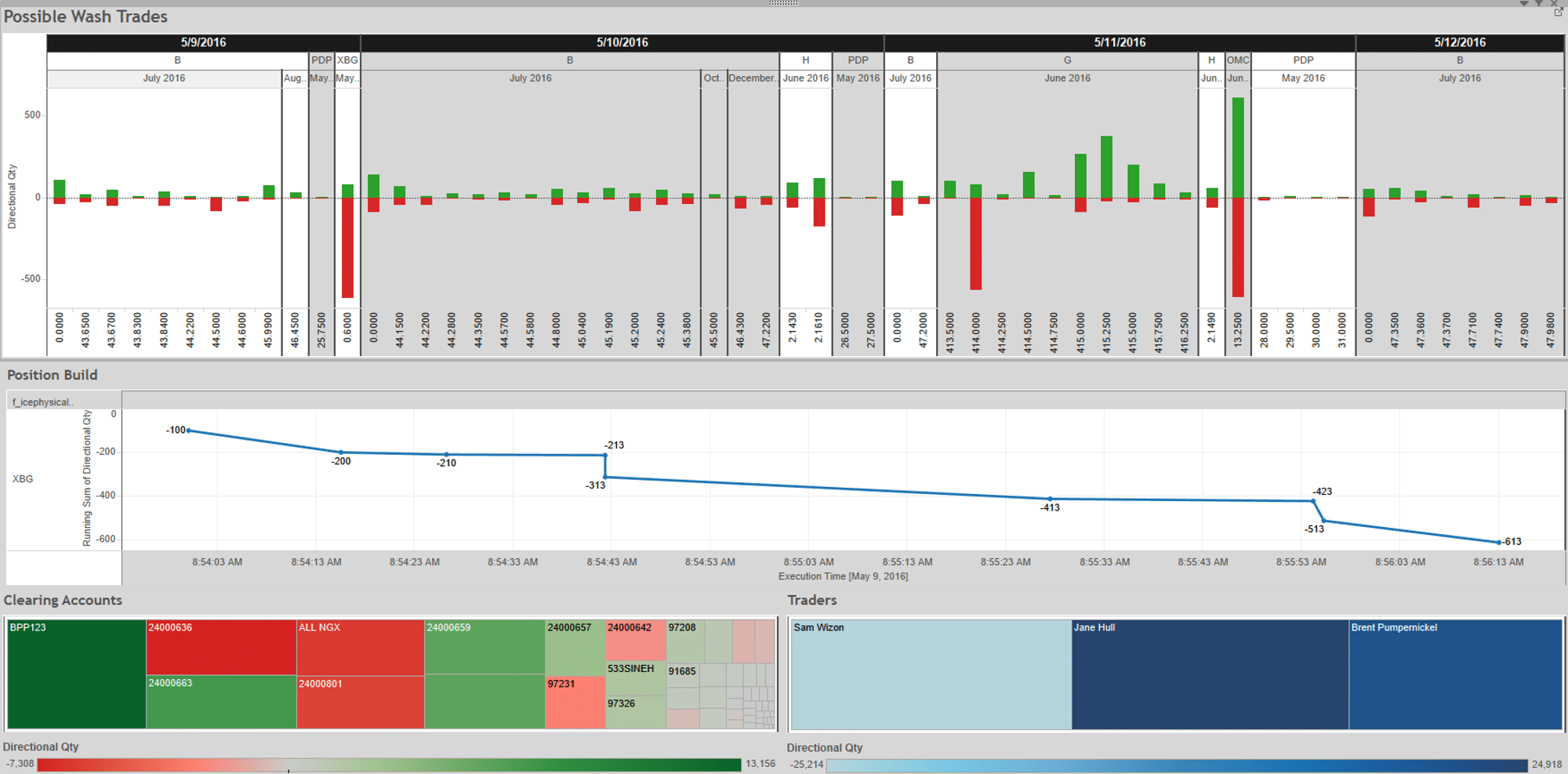

Here is an example: Anytime we trade in and out at or near the same price…it shows up on this chart.