K3 for Trading

Regulatory Reporting

Seamless Compliance with Streamlined Regulatory Reporting

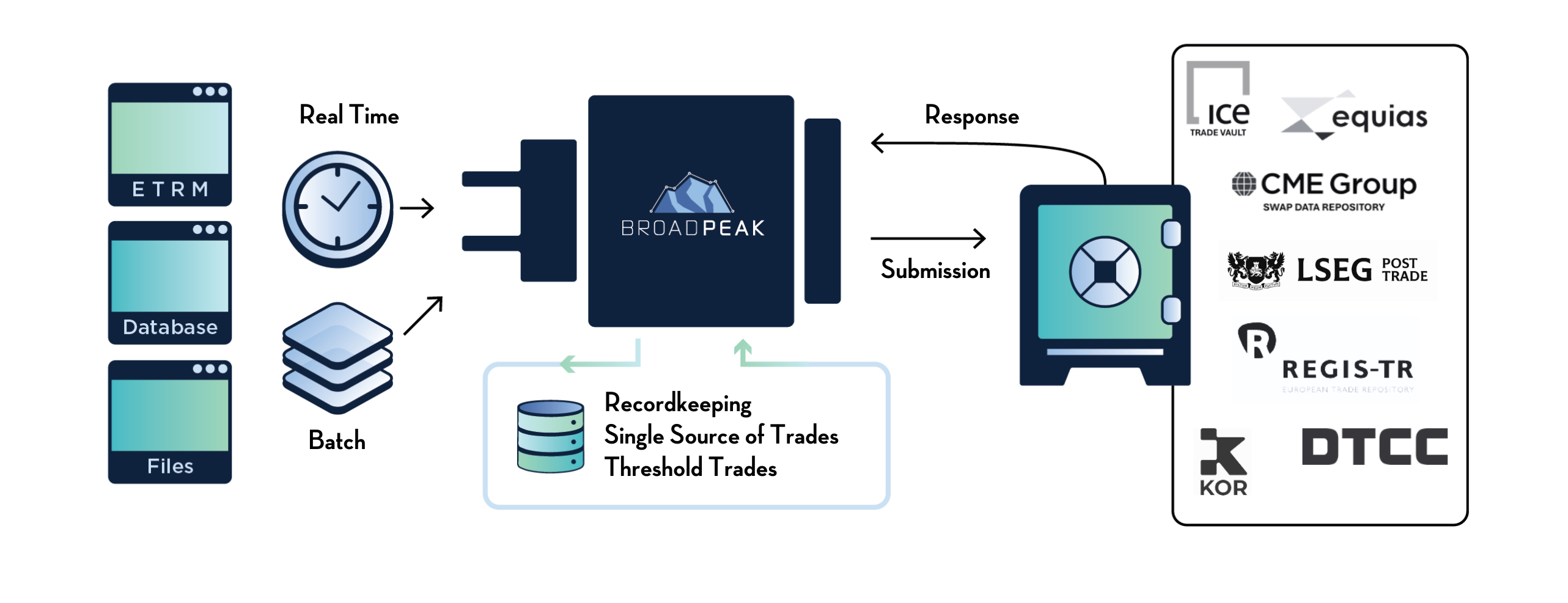

We simplify regulatory reporting with our range of pre-built adapters for leading Trade Repositories (TRs) like ICE Trade Vault, DTCC, CME Swap Data Repository (SDR), Equias, and LSEG Post-trade (formerly UnaVista). Leveraging K3’s regulatory reporting module helps you effortlessly meet regulatory reporting requirements of jurisdictions including US, UK, Europe, Canada, Singapore and Australia.

K3’s prebuilt adaptors communicate with and report to DTCC and other Swap Data Repositories out of the box, reducing friction and saving time.

Benefits:

Integration:

Our platform seamlessly integrates with existing trading systems, converting trades into the necessary TR format and submitting them automatically.

Real-time Confirms:

Receive real-time confirmations and instant alerts for any submission errors, ensuring compliance without hassle.

Support:

Proactive technical maintenance and support ensure you stay ahead of upcoming changes and benefit from our extensive expertise: we have over 8 years of close collaboration with global repositories and the ICE eConfirm team.

Monitoring:

We monitor updates for most requirements for relevant regimes across G20 nations, ensuring compliance with changing regulations like EMIR Refit in the EU. We automatically change data routes to regulatory repositories so you don't have to worry about costly and time-consuming coding changes.

Our standard adapters provide comprehensive coverage for you across various regulatory regimes, including:

- Dodd-Frank

- EMIR Trade Reporting

- MiFID II

- REMIT Trade Reporting

- Australian Trade Reporting (ASIC)

- Canada Trade Reporting

- MAS Trade Reporting

- FinFrag Trade Reporting

- Security-Based Swap Reporting (SBSR SEC)

- Large Trader Reporting (CFTC)

- UK SFTR