Categories

Categories

How K3 Limits Became the Gold Standard in Calculating Exchange Position Limits

In today’s rapidly evolving regulatory landscape, many asset managers struggle keeping track of their compliance status. With regulations and trading parameters becoming ever more complex,

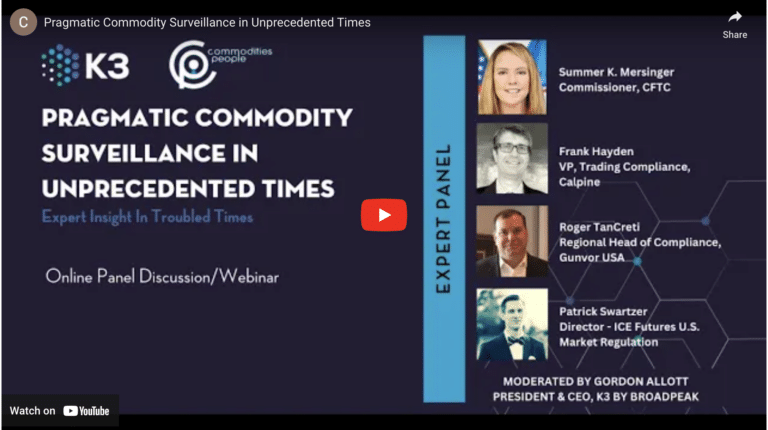

Pragmatic Commodity Surveillance in Unprecedented Times

Online Panel Discussion/Webinar Watch the replay of our recent Webinar moderated by Gordon Allott featuring an expert panel: Summer K. Mersinger Commissioner, CFTC Frank Hayden

We put our web data onto ChatGPT. Here’s what we found.

We took our website and fed it into ChatGPT to find out what there was to find out. Here it is. Ask anything you like.

Aged, Application, Stalker, Spy

There’s a great saying. “It’s good to watch your competition, just don’t stare.” Pega Systems, a four billion dollar company, just got hit with a

4 Low-code Trends to Watch in 2023

The global market for low-code development technologies is projected to total $26.9 billion in 2023, an increase of nearly 20% from 2022, according to the latest forecast from Gartner, Inc.

So boring…we read it so you don’t have to

IOSCO. Who are they? Remember when the G20 got together post financial crisis and agreed to implement things like Dodd-Frank, EMIR, MiFID, MAS etc? Well,