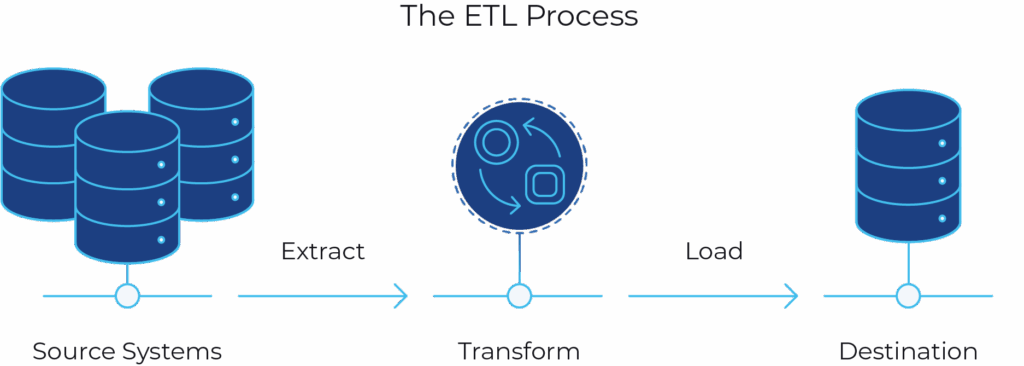

Trading firms run on data. Market prices, positions, settlements, risk metrics, all of it flows through your systems every day. Raw data from exchanges, brokers, and trading platforms needs processing before traders and analysts can use it. ETL (extract, transform, load) is the process that turns messy trade data into clean, reliable data your firm can trust. A robust ETL framework is essential for any energy and commodity trading firm that wants to compete.

Establishing an ETL Framework

Energy and commodity trading firms handle data from dozens of sources. ICE sends natural gas prices. CME delivers crude oil futures. Your E/CTRM system tracks physical positions. Risk platforms calculate exposure. Settlement systems process invoices. Each source uses different formats, timing, and structures.

Between 2016 and 2018, 90% of global data was created(1). Trading firms feel this pressure more than most.

Every new trading venue means another data feed. Every regulatory change means more reporting. Every market you enter means more data to manage. The need to turn all this trading data into usable information keeps growing.

An ETL framework gives energy and commodity trading firms a structured and repeatable way to map, process, and deliver data across all these systems. ETL handles the detailed work of connecting market data providers, E/CTRM systems, risk platforms, and settlement tools. An ETL tool such as BroadPeak can reduce the workload and support both IT teams and trading analysts by offering a practical way to work with diverse trading data sources.

The benefits of an ETL framework

Trading operations create unique data challenges. Market feeds arrive in different formats. Exchange specifications change without warning. Legacy systems use outdated data structures. Position data sits in one system while pricing lives in another. An ETL tool removes these obstacles.

Technical teams no longer need to write custom code every time ICE changes a file format or your firm adds a new broker feed. A tool such as BroadPeak connects to exchanges, E/CTRM systems, market data providers, and risk platforms. It delivers normalized data directly into your data warehouse or analytics tools without custom code for each connection. A clear ETL framework saves time, reduces errors in position reports, and lowers operational costs.

There are many tools that claim to handle trading data. Over time, ETL tools became large, expensive, and built mainly for developers. Trading firms that need to connect a few key systems, market data to E/CTRM, E/CTRM to risk, positions to P&L, often find themselves with tools that are oversized for the job. It is similar to using a chainsaw to slice bread. It works, but it creates a mess.

BroadPeak follows a different approach. After years of working with trading firms and their data challenges, we saw that the main barrier was the difficulty of keeping ETL systems aligned with market needs. Exchange formats change. Regulatory requirements evolve. New products launch.

Large ETL systems are slow to adapt, and traders cannot wait days for IT to update data pipelines.

BroadPeak separates responsibilities. Developers build connections to exchanges and trading systems, while trading analysts and operations staff manage the data layer. They control the mapping rules, transformation logic, and data flows they use every day for position reports, P&L calculations, and risk analysis. Each group works where they add the most value.

Analysts adjust curves and settle prices without waiting on IT. Developers avoid constant maintenance when, for example, CME updates a contract specification and can focus on higher-value projects

ETL framework challenges

ETL frameworks help energy and commodity trading firms map, normalize, and prepare data from multiple sources so they can make fast decisions. ETL may sound like a three-step process, but it requires data engineering, trading knowledge, system expertise, and ongoing governance.

Many companies struggle with large data projects. McKinsey reports that most major IT projects run 45 percent over budget(2). Trading firms also experience long delays when delivering ETL work. One reason is the shortage of developers who understand both technology and trading operations. Below are three considerations for building an ETL framework that supports your trading desk.

Data integrity and long-term sustainability.

A skilled developer can write a quick script when ICE changes a natural gas pricing format or when you need to add a new counterparty to your settlement process. It may solve the issue today, but it creates problems tomorrow. These one-off fixes usually sit outside your standard development process. They also tie your trading data to one person. If that developer gets pulled into another project during a busy trading period or leaves the company, your position data stops flowing. Your traders lose visibility. Your risk team cannot calculate exposure. Your operations team cannot settle trades.

Best practice: Choose an ETL tool that trading firms can sustain over time. BroadPeak’s ETL feature and low-code connectors deliver reliable data without custom coding. Trading analysts can manage most ETL functions themselves. This is critical when exchanges update formats, regulators add reporting requirements, or your firm enters new markets. Your analysts adjust the data flows. Your developers stay focused on strategic projects.

Data transformation relies on clear structure

Raw trading data is messy. Market feeds from ICE do not match CME formats. Your legacy E/CTRM system stores positions differently than your new risk platform. Settlement data from brokers arrives in dozens of spreadsheet formats. Physical delivery schedules use different units than your financial hedges. The moment you decide to move trading data between systems, you need transformation. This includes mapping exchange codes to internal product names, converting units, organizing pricing curves, and preparing data from multiple sources into one consistent structure.

Best practice: An ETL tool that is both intuitive and ready is essential when handling different trading data formats and legacy systems. BroadPeak preps data from various sources including ICE, CME, broker confirmations, and internal platforms into one usable format. It handles real-time market data, end-of-day settlements, position snapshots, and P&L reports. It allows code-free transformation through a mapping and rules engine built for trading operations.

Using a solution like BroadPeak makes it possible to connect multiple exchanges, brokers, and internal systems without writing custom code for each data source.

Models need clean data first

Getting control of your trading data is one challenge. Building models to optimize trading strategies or predict price movements is another. The important part is that one always comes before the other. Your quants cannot build accurate models if position data is inconsistent. Your traders cannot trust analytics if settlement data is incomplete. Your risk team cannot calculate exposure if market prices are not current.

Best practice: If you are building a quantitative trading team or struggling with your analytics capabilities, start with data quality first. Many trading firms make the mistake of hiring quants and data scientists before they solve basic data problems. They expect these teams to deliver insights when the underlying data, positions, prices, settlements, is scattered across disconnected systems. BroadPeak helps you establish clean, reliable data flows first. Then your analytics team can focus on generating value instead of fixing data problems.

Managing change in trading operations

Energy and commodity trading firms face constant data pressure. Trading activity expands into new markets and products. Each new venue, counterparty, or instrument generates more data to capture and process. Regulations evolve, adding reporting requirements for EMIR, MiFID, Dodd-Frank, and other mandates. These rules demand accurate audit trails, timely submissions, and detailed recordkeeping.

System changes add more complexity. Firms upgrade E/CTRM platforms, add new risk tools, implement trade capture solutions, or connect to new execution venues. Each system produces data that must integrate with existing infrastructure.

Market data from one exchange must match position data in your E/CTRM. Risk calculations must align with settlement data. P&L reports must reconcile across platforms.

A clear plan for how trading data moves through your organization helps your firm manage these pressures. It allows your team to adjust when exchanges change formats, regulators add requirements, or your firm enters new markets. It keeps operations running smoothly when IT resources are limited. It supports faster, more accurate decision-making across your trading desk, risk management, and back office operations.

Making your data work

BroadPeak’s low-code Data Integration solution provides energy and commodity trading firms with a powerful way to unify and validate data from a wide range of sources, including legacy systems, APIs, and global exchange feeds. Rather than managing fragmented, error-prone data flows, trading, risk, and compliance teams get access to clean, normalized data that can be streamed into downstream systems. This eliminates manual data wrangling, reduces operational risk, and speeds up decision-making.

BroadPeak supports direct connectivity to 30+ exchanges including ICE, CME, and Nodal and automates data quality checks. This means clients can automate trade capture, allocate data consistently, and ensure that regulatory reporting or surveillance workflows are fed from a trustworthy “single source of truth.”

BroadPeak’s low-code approach enables data-driven decisions for all users, with or without IT support. This autonomy drives faster problem-solving and more confident decision-making enterprise wide.

Learn more BroadPeak Data Integration →